Choosing the right payment gateway can make or break your online business in the Philippines. You’ve probably spent countless hours building your store, sourcing products, and creating marketing campaigns—only to lose potential customers at checkout because of payment issues. Sound familiar?

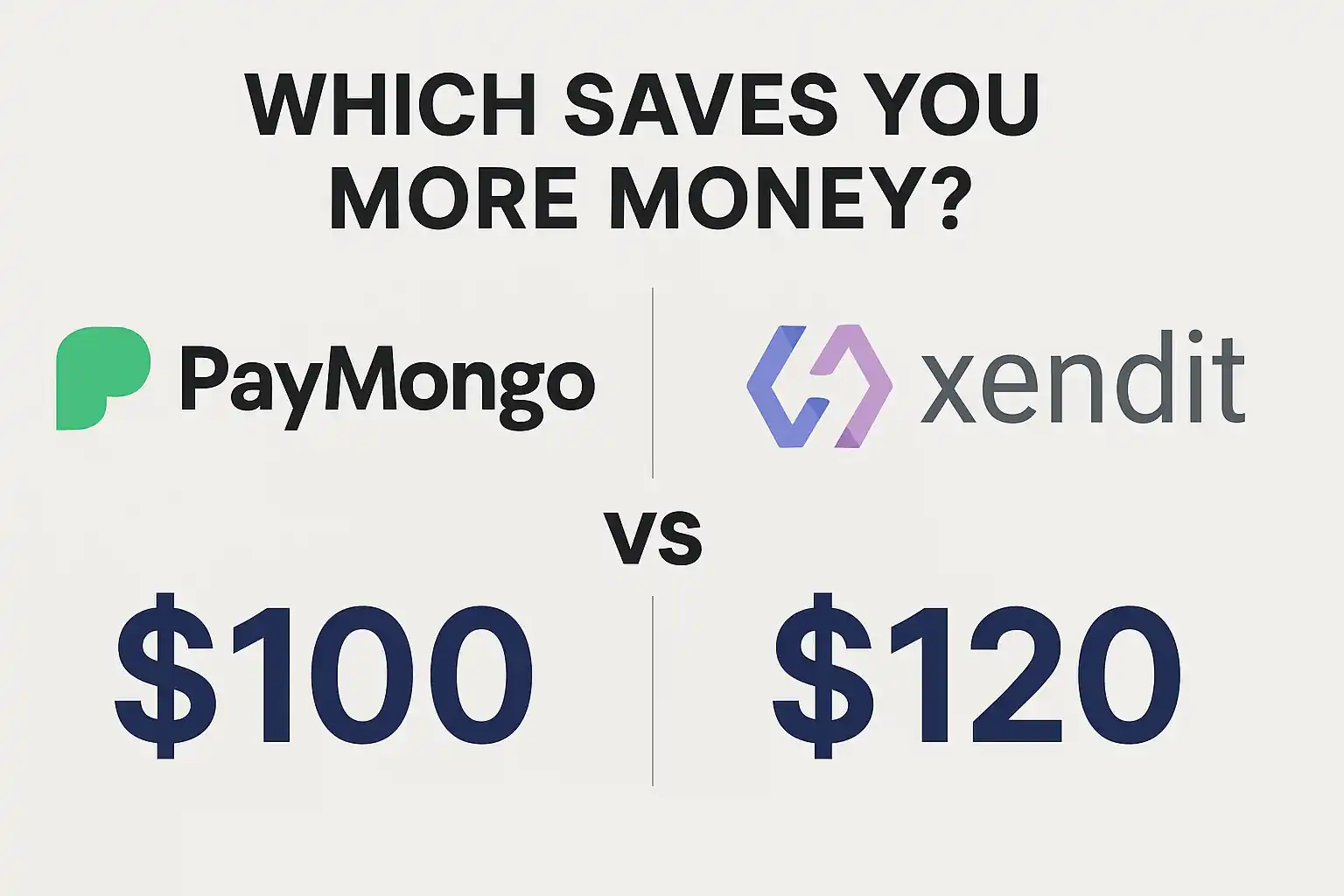

When it comes to paymongo vs xendit, both platforms have emerged as leading payment solutions for Filipino entrepreneurs and businesses. But which one deserves your trust and your customers’ transactions? In this comprehensive comparison, we’ll dive deep into everything you need to know about these two payment gateways—from pricing and features to integration ease and customer support—so you can make an informed decision that impacts your bottom line.

Whether you’re launching your first online store or looking to switch from your current provider, understanding the differences between PayMongo and Xendit will save you time, money, and headaches down the road.

Table of Contents

ToggleBefore we jump into the paymongo vs xendit showdown, let’s clarify what you’re actually choosing between. A payment gateway is the technology that securely processes credit card and digital wallet payments from your customers to your business account. Think of it as the digital equivalent of a card terminal in physical stores.

For Philippine-based businesses, your payment gateway needs to handle:

The right choice affects your conversion rates, operational efficiency, and customer satisfaction. Let’s see how PayMongo and Xendit stack up.

PayMongo is a Filipino fintech company that launched in 2019, specifically designed to address the payment challenges faced by Philippine businesses. As a homegrown solution, it understands the local market’s unique needs and payment preferences.

Payment Methods Supported:

Technical Capabilities:

The paymongo api is well-documented and developer-friendly, making it easier for businesses with technical teams to implement custom solutions. The paymongo api documentation provides clear examples and use cases, which is particularly helpful if you’re building custom integrations.

Integration Options:

Understanding the paymongo fee structure is crucial for calculating your actual profit margins:

The paymongo rates are transparent and competitive, especially for businesses processing higher volumes.

For technically-inclined businesses, the paymongo developer resources are comprehensive. The platform offers:

You can create a paymongo account and start testing within minutes using their test environment.

Xendit is a Southeast Asian payment gateway founded in 2015, operating across Indonesia, the Philippines, Thailand, Vietnam, and Malaysia. It brings regional expertise and a broader feature set to the table.

Payment Methods Supported:

Advanced Capabilities:

Integration Options:

Xendit’s pricing structure varies by payment method:

Enterprise clients can negotiate custom pricing based on volume.

Xendit provides robust technical documentation:

Winner: Tie

Both platforms offer nearly identical pricing for credit cards and e-wallets. Your decision here shouldn’t be based solely on fees, as they’re competitive with industry standards.

Consider this: Calculate your expected transaction mix. If you’ll process many bank transfers or over-the-counter payments, Xendit’s lower fees for these methods could save you money.

Winner: Xendit

While PayMongo covers the essential payment methods Filipino consumers use, Xendit offers more options, particularly:

If your target market includes customers without credit cards or e-wallets, Xendit’s broader payment options give you an edge.

Winner: PayMongo

For the paymongo woocommerce integration specifically, users consistently report smoother setup experiences. The paymongo integration process is straightforward, with clear documentation and fewer technical hurdles.

PayMongo’s focus on the Philippine market means their plugins and integrations are optimized for local platforms and use cases. The paymongo dashboard login interface is intuitive, even for non-technical users.

Winner: PayMongo

The paymongo api documentation receives high marks from developers for clarity and completeness. While Xendit’s documentation is comprehensive, PayMongo’s is more beginner-friendly with better examples.

PayMongo test cards are clearly documented, making sandbox testing straightforward. The paymongo developer community is active and responsive, with regular updates and improvements.

Winner: PayMongo

PayMongo customer service is frequently praised for responsiveness and local understanding. Since they’re Philippines-focused, support agents understand local business challenges and can provide relevant solutions.

Response times are generally faster, and you’ll communicate with people who understand the Philippine e-commerce landscape. Support is available via:

Xendit’s support is professional but serves multiple countries, which can sometimes lead to less personalized assistance for Philippine-specific issues.

Winner: Tie

Both platforms offer similar settlement periods:

Your cash flow won’t be significantly impacted by choosing one over the other.

Winner: Tie

Both PayMongo and Xendit are:

Your customers’ payment information is equally secure with either provider.

Winner: Xendit

For growing businesses with complex needs, Xendit offers more advanced features:

If you’re planning to scale regionally or need sophisticated payment workflows, Xendit provides more room to grow.

Winner: Xendit

Xendit’s dashboard provides more detailed analytics and reporting tools:

PayMongo’s reporting is adequate for most businesses but less comprehensive for data-driven operations.

PayMongo Advantages:

Xendit Advantages:

✅ You’re a small to medium-sized Philippine business

✅ You prioritize ease of setup and use

✅ You mainly need card and e-wallet payments

✅ You value responsive, locally-focused customer support

✅ You’re using WooCommerce or Shopify

✅ You’re a social seller needing simple payment links

✅ You want straightforward, transparent pricing

Best for: Startups, SMEs, social commerce sellers, and businesses focused exclusively on the Philippine market.

✅ You need diverse payment methods (OTC, bank transfers, installments)

✅ You’re planning regional expansion beyond the Philippines

✅ You need advanced features like disbursements or recurring billing

✅ You operate a marketplace or platform business

✅ You require detailed analytics and reporting

✅ You have customers without credit cards or e-wallets

✅ You’re processing high volumes and can negotiate rates

Best for: Growing businesses, marketplaces, subscription services, and companies with plans for regional expansion.

Maria runs an online fashion boutique primarily through Instagram and Facebook. She uses a simple website for checkout.

Best Choice: PayMongo

Why? Maria needs simple payment links she can share on social media, easy setup without technical knowledge, and responsive support when issues arise. The paymongo payment gateway payment links feature is perfect for her social-first business model.

Juan operates an electronics store with both online and physical locations. Many customers prefer installment payments or over-the-counter options.

Best Choice: Xendit

Why? Juan’s customers need flexible payment options beyond cards and e-wallets. Xendit’s OTC payment channels and installment partnerships better serve his diverse customer base.

Ana launched a monthly subscription box service for beauty products.

Best Choice: Xendit

Why? Ana needs recurring billing capabilities to automatically charge customers monthly. Xendit’s subscription management features make this seamless, while PayMongo would require more manual processing.

Carlos is starting a dropshipping business with limited technical knowledge.

Best Choice: PayMongo

Why? Carlos needs quick setup, easy paymongo woocommerce integration, and straightforward management. PayMongo’s simplicity lets him focus on marketing and sales rather than payment technicalities.

The entire process typically takes 2-5 days, depending on verification speed.

Xendit’s setup may take slightly longer due to more payment method configurations.

Don’t make your decision solely on transaction fees. Consider:

A slightly higher fee with better conversion rates and support is worth it.

Understand how your customers prefer to pay. If they’re primarily young, urban consumers, cards and e-wallets suffice. If you serve a broader demographic, you’ll need more payment options.

Assess your technical capabilities honestly. If you don’t have a developer and need quick setup, prioritize ease of use over advanced features you won’t utilize.

Always test your payment integration extensively before launch:

Use paymongo test cards or Xendit’s test environment to simulate various scenarios.

Factor settlement times into your cash flow planning. If you need faster access to funds, check if either platform offers accelerated settlement options for established businesses.

Yes, you can integrate both payment gateways and let customers choose. However, this adds complexity to your reconciliation and reporting. Most businesses find that one gateway meets their needs.

Both platforms maintain high uptime (99%+). PayMongo and Xendit are equally reliable for processing payments.

Yes, you can switch, though it requires technical work to change integrations. Choose carefully to avoid this hassle, but know you’re not permanently locked in.

Both accept international credit cards. Xendit offers better multi-currency support if you’re selling internationally.

Both platforms handle chargebacks similarly. You’ll be notified of disputes and can submit evidence. Neither platform is significantly better at dispute resolution.

No, both PayMongo and Xendit welcome businesses of all sizes without minimum volume requirements.

After this comprehensive comparison of paymongo vs xendit, here’s the bottom line:

For most small to medium Philippine online stores, PayMongo is the better choice. Its combination of ease of use, excellent local support, straightforward pricing, and focus on the Philippine market makes it ideal for businesses that want to start accepting payments quickly without complications.

However, Xendit becomes the better option when you need diverse payment methods, advanced features like disbursements, or plan to expand regionally. Larger businesses and marketplaces will appreciate Xendit’s sophisticated capabilities.

Neither choice is wrong—both are legitimate, secure, and competitive payment gateways. Your decision should align with your specific business needs, technical capabilities, and growth plans.

Ready to choose your payment gateway? Here’s what to do:

Remember, the best payment gateway is the one that your customers can use easily and that you can manage confidently. Both PayMongo and Xendit serve thousands of successful Philippine businesses—now it’s time to join them.

Have you used either PayMongo or Xendit for your online store? Share your experience in the comments below to help other entrepreneurs make their decision!

Professional

Expert web development services to grow your business online

Custom website development

Launch a powerful online store

Increase your visibility on search engines

Lightning-fast loading speeds

Protect your digital investment

Master form conditional logic in WordPress with Bit Form. Learn how to create smart, dynamic forms using drag-drop builders and conditional rules step-by-step.

Learn Bit Form WordPress plugin inside out. Create contact forms, multi-step applications & surveys. Expert tips for conditional logic & styling.

Guide to integrating PayMongo payment gateway with WordPress and Shopify. Learn about GCash, fees, webhooks, test cards, and developer tools.

Discover the key differences between e-commerce platforms and marketplaces. Learn which option suits your business best with real examples and expert insights.

Discover proven website design strategies for gyms that convert visitors into members. Includes examples, best practices, and SEO tips for fitness websites.

Discover the best WordPress backups strategies and plugins in 2024. Compare UpdraftPlus, WPvivid, and top backup solutions. Protect your site with automatic backups today!

At KS Code, we specialize in crafting high-performing, visually stunning websites tailored to your business needs. From responsive designs to powerful e-commerce solutions, our goal is to help you stand out, engage users, and drive results online.