You’ve chosen PayMongo as your payment processor, but now you’re staring at documentation, wondering how to actually connect it to your WordPress or Shopify store. The good news? PayMongo’s integration is more straightforward than most Philippine payment gateways—once you understand the platform’s structure and requirements.

This integration approach is a key part of our wider guide on Payment Gateway Integration API for Philippine E-Commerce Sites 2025, where we compare the technical requirements across different providers. Here, we’re diving deep into PayMongo’s specific implementation for the two most popular e-commerce platforms in the Philippines.

Table of Contents

TogglePayMongo Philippines Inc is a Y Combinator-backed fintech company that provides payment infrastructure for Philippine businesses. Unlike traditional merchant accounts that require weeks of paperwork, PayMongo offers API-first payment processing with same-day approval for most businesses.

Quick Answer: PayMongo is a payment gateway that lets Philippine online stores accept credit cards, debit cards, GCash, and GrabPay through a single integration. It’s designed specifically for developers and non-technical store owners who need reliable payment processing without the complexity of traditional banks.

The platform stands out because it handles both online checkout and payment links, supports installment payments, and provides webhook notifications for real-time order updates—features that matter when you’re running a growing e-commerce operation.

WordPress users have two distinct integration options, and your choice depends on whether you’re using WooCommerce or another e-commerce solution.

The PayMongo plugin for WooCommerce is the fastest path to accepting payments. Here’s what you need to know:

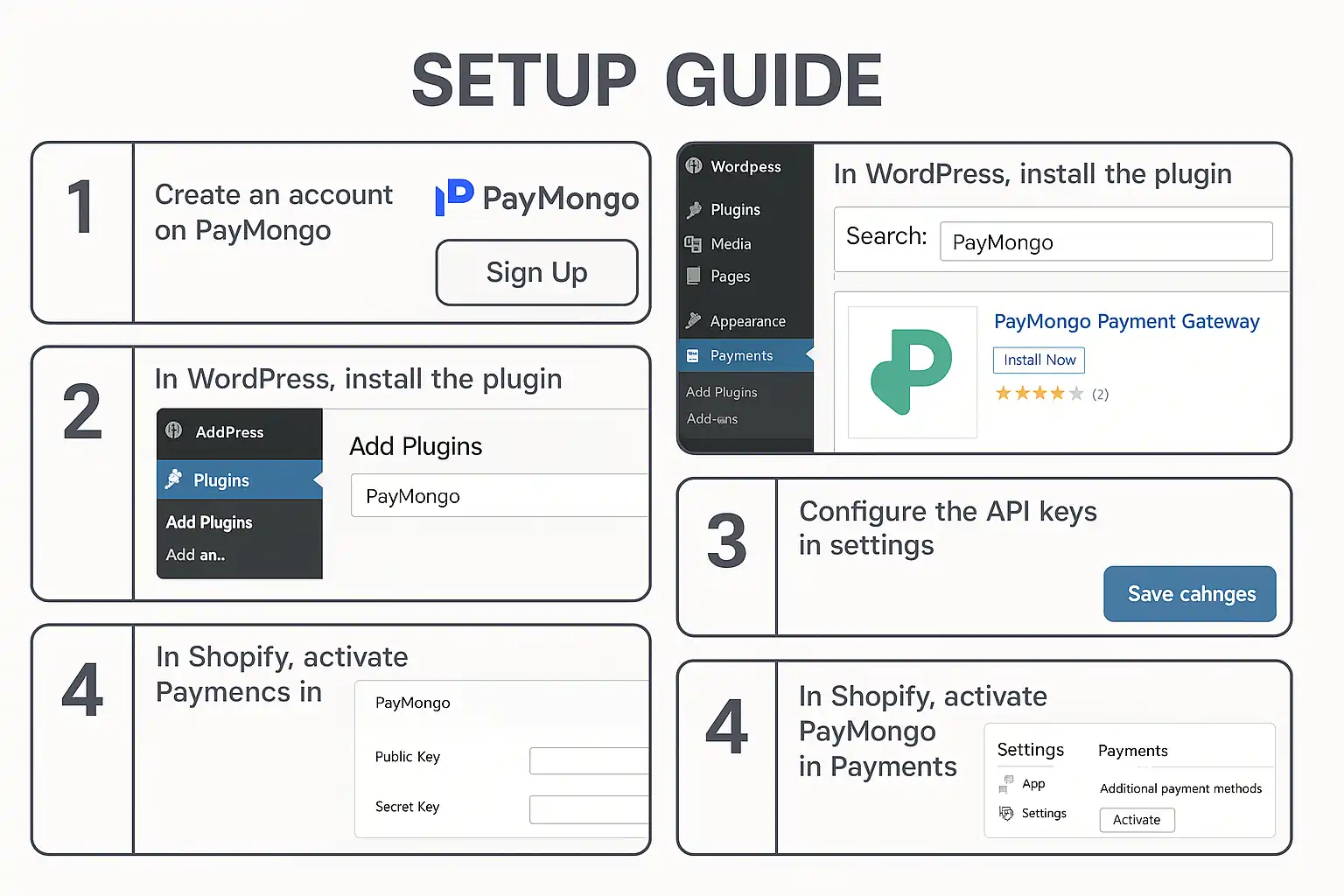

Installation Process:

The plugin automatically handles the checkout flow, creates payment intents, and updates order statuses when payments complete. You don’t need to write code or understand APIs.

Key Configuration Settings:

If you’re building a custom WordPress solution outside WooCommerce, you’ll work directly with the PayMongo developer API. This requires PHP knowledge but gives you complete control.

The core workflow involves:

You’ll need to store your secret API key securely (never in JavaScript) and implement proper error handling for declined transactions.

PayMongo Shopify integration is simpler than WordPress because Shopify’s payment provider API is standardized.

Install the PayMongo app from the Shopify App Store. The setup takes about 10 minutes:

Important limitation: Shopify takes a transaction fee on top of PayMongo’s rates if you’re not on Shopify Plus. This is Shopify’s policy for third-party payment gateways, not a PayMongo fee.

For Shopify Plus merchants, you can build a custom payment integration using Shopify’s Payment Apps API. This removes Shopify’s additional transaction fees but requires:

Most merchants stick with the app unless transaction volume justifies the development cost. When evaluating total costs across providers, check out our comparison at PayMongo vs Xendit: Which Saves You More Money to understand how fees stack up.

PayMongo GCash is one of the most requested payment methods in the Philippines. Here’s how it works technically:

When a customer selects GCash at checkout:

Critical implementation detail: GCash payments are asynchronous. The customer might close their browser after paying but before the redirect completes. Your webhook handler must be the source of truth for payment confirmation, not the redirect callback.

The same flow applies to GrabPay and other e-wallet options PayMongo supports.

While we can’t discuss specific rates, understanding the PayMongo fee structure helps you implement the right features:

Fee Components:

Implementation impact: Your checkout should display the final amount the customer pays. Some merchants absorb payment fees; others pass them to customers. If you’re passing fees, calculate them before the payment intent is created—changing amounts after a payment is initiated violates card network rules.

PayMongo’s dashboard shows your effective PayMongo rates based on your monthly volume, which can help you forecast costs as you scale.

PayMongo test cards are essential for development. Never test with real card numbers, even your own.

Test Card Numbers:

Testing checklist before going live:

Use test mode API keys for all testing. PayMongo’s test environment is completely separate from production—no real money moves.

PayMongo webhook notifications are how your store learns about payment status changes. This is non-negotiable for production sites.

Essential webhook events:

Implementation requirements:

Common mistake: Performing slow operations (sending emails, updating inventory) inside the webhook handler. Instead, save the event and process it asynchronously. PayMongo will retry failed webhooks, but if your endpoint consistently times out, they’ll disable it.

For WordPress, the PayMongo plugin handles webhooks automatically. For custom integrations, you’ll implement this in PHP, Node.js, or your backend language of choice.

The PayMongo developer documentation is comprehensive, but here are the practical tips that aren’t obvious:

API Key Management:

Rate Limiting:

PayMongo implements rate limits on API calls. For high-volume stores:

Error Handling:

PayMongo returns detailed error codes. Don’t show raw API errors to customers—map them to user-friendly messages:

SDK Options:

Before switching from test to production mode:

Technical verification:

Compliance requirements:

Customer experience:

“Webhook not receiving events”

“Payment succeeds but order stays pending”

“GCash payments not working”

“3D Secure authentication fails”

A: No, PayMongo Philippines Inc requires business registration documents (DTI, SEC, or Mayor’s Permit) during account verification. Sole proprietors can register with DTI registration.

A: PayMongo typically processes payouts within 2-3 business days after a successful transaction. You can configure payout schedules (daily, weekly, or monthly) in your dashboard settings.

A: Yes, the PayMongo WooCommerce plugin works with any WordPress theme or page builder since it integrates at the WooCommerce checkout level, not the page design level.

A: Yes, PayMongo supports customer vaults for storing payment methods securely. You’ll need to implement this using the Payment Methods API—it’s not automatic in the basic plugin.

A: Your webhook handler will still receive the source.chargeable event from PayMongo, allowing you to mark the order as paid even if the customer closed their browser. This is why webhook implementation is critical.

Professional

Expert web development services to grow your business online

Custom website development

Launch a powerful online store

Increase your visibility on search engines

Lightning-fast loading speeds

Protect your digital investment

Master form conditional logic in WordPress with Bit Form. Learn how to create smart, dynamic forms using drag-drop builders and conditional rules step-by-step.

Learn Bit Form WordPress plugin inside out. Create contact forms, multi-step applications & surveys. Expert tips for conditional logic & styling.

Compare PayMongo vs Xendit for your Philippine online store. Discover fees, features, integration options, and which payment gateway fits your business needs.

Discover the key differences between e-commerce platforms and marketplaces. Learn which option suits your business best with real examples and expert insights.

Discover proven website design strategies for gyms that convert visitors into members. Includes examples, best practices, and SEO tips for fitness websites.

Discover the best WordPress backups strategies and plugins in 2024. Compare UpdraftPlus, WPvivid, and top backup solutions. Protect your site with automatic backups today!

At KS Code, we specialize in crafting high-performing, visually stunning websites tailored to your business needs. From responsive designs to powerful e-commerce solutions, our goal is to help you stand out, engage users, and drive results online.